In part one of this two-part series on the circular economy, we investigated consumer perspectives of sustainable business practices. In this second part, we find out if consumer habits and preferences in the resale market translate into sustainable efforts. Is buying second-hand still synonymous with the environmentally conscious consumer or are consumers driven by saving money rather than the planet? Here, we find out.

In this article

- The surging second-hand economy in Australia

- Low consumer engagement in sustainable buy-back programs

- Consumers have no preference for where to buy second-hand items

- Consumers buy second-hand to save money, not the planet

- Online marketplaces attract second-hand sellers

- Opportunities for specialised online stores

Australia is experiencing the highest inflation rate in over 30 years, recorded at 6.1% in June and anticipated to climb further. The impact of such is cause for conservative spending, which may have also sparked growth in the second-hand economy. As the cost of living rises, Australians are discovering the value of second-hand markets, with online resale platforms such as Gumtree, eBay, and Facebook Marketplace reporting a surge in activity.

Buying second-hand was increasing in popularity before the pandemic, with a widespread interest in shopping responsibly and sustainably. However, is necessity and hardship now leading us towards a new era of second-hand buying and selling? Businesses looking for eCommerce opportunities in the resale market will need to evaluate the habits and preferences of consumers to edge forward in this growing space.

GetApp surveyed over 1,000 Australians to determine their motives for buying or selling second-hand products. We asked respondents what, where, and why they choose to buy and sell second-hand, and whether they participate in buy-back programs. Finally, we evaluate online and offline channels for buying and selling second-hand items. Scroll to the end for the full methodology.

The surging second-hand economy in Australia

The current economic downturn has left many consumers wary of rising costs, and many may be looking for more affordable purchase options. At the same time, resale platforms enable consumers to earn money from goods they no longer use or prefer to sell for extra income.

Pre-pandemic, growing consumer interest in the second-hand economy may have been fuelled by a backlash to fast fashion, with environmentally conscious consumers wanting to avoid the waste and emissions associated with buying new items. Buying second-hand is a way to prolong the lifespan of products and materials instead of them typically being thrown away.

The annual second-hand economy report commissioned by the online classifieds website Gumtree estimates the total value of the second-hand economy as higher than any other year, at $46 billion. Other platforms, such as Facebook Marketplace, are investing in building the future of commerce. The buy and sell platform has already surpassed one billion users, with a million online shops and 250 million users interacting each month.

Low consumer engagement in sustainable buy-back programs

While some Australians are turning to the second-hand economy to sell their pre-loved items, given the current economic climate, others may be chasing bargains or contributing to the environmental benefits of buying second-hand.

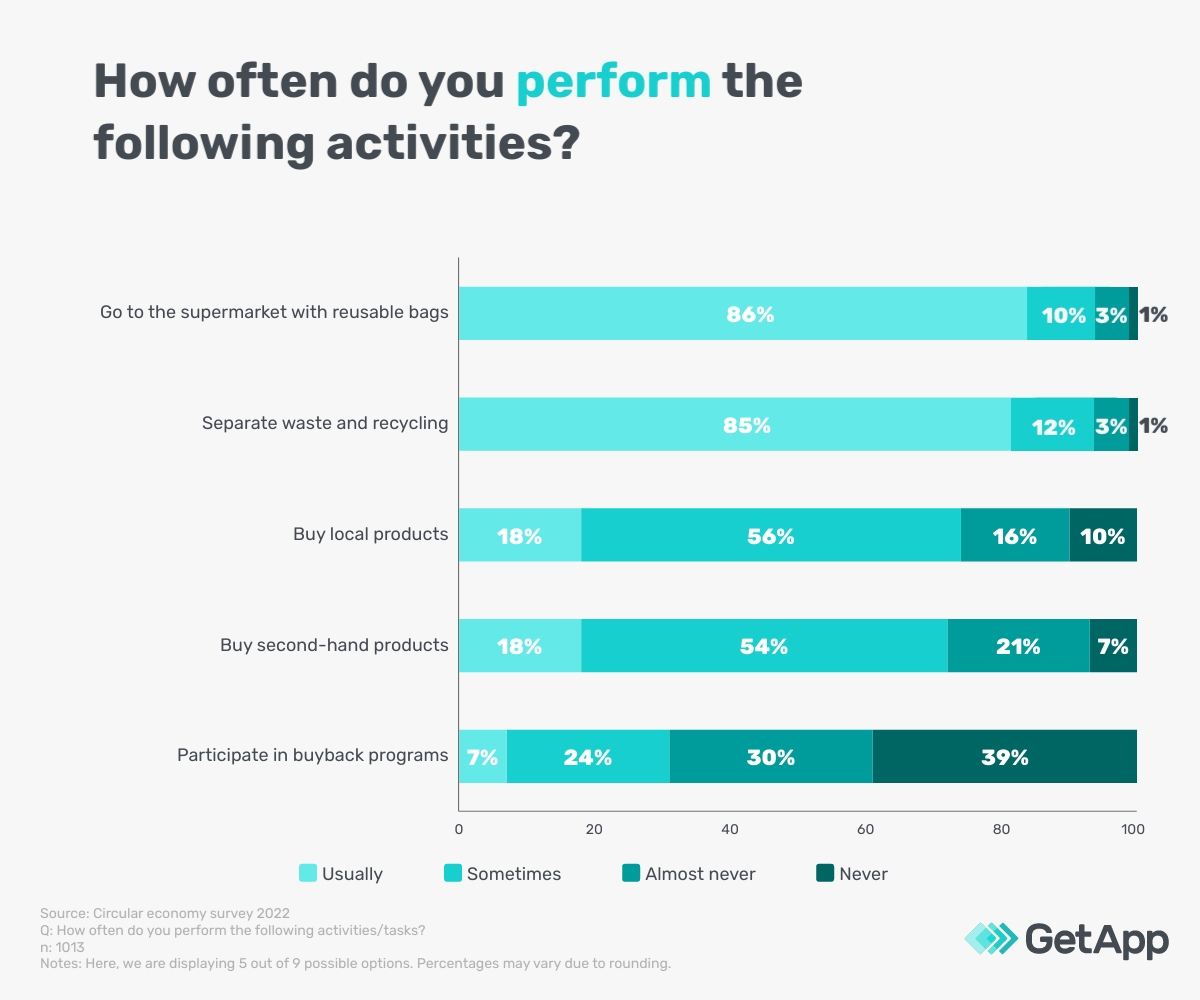

The results from our survey revealed that although respondents show a high level of commitment to environmental efforts like going to the supermarket with reusable bags or separating their waste, they engaged less frequently in other activities that promote sustainable consumption.

To aid sustainable consumption in Australia, the Product Stewardship Act 2011 is an adaptable approach to managing the environmental impacts of products and materials by acknowledging shared responsibility for those that produce, sell, use, and dispose of products to reduce negative impacts.

Extended producer responsibility (EPR) schemes are a type of product stewardship that places primary responsibility on the manufacturer or seller of a product. EPR takes into account environmental considerations in production processes throughout the product chain, such as by integrating the paid collection of recyclables —via buy-back programs, for example. Strikingly, a combined 69% of respondents said they ‘never’ or ‘almost never’ participate in buy-back programs.

What is a buy-back program?

A buy-back or take-back program is a way retailers and manufacturers are collecting used products or materials back from the consumer, often in exchange for store credit. As a result, buy-back programs remanufacture materials and raise awareness for consumers to dispose of their waste consciously.

Although the majority of consumers are not very engaged in buy-back programs, businesses looking to increase their sustainability effort may want to consider offering this option. To implement this type of initiative, companies must engage consumers through effective communication channels and education.

The furniture manufacturer Ikea offers customers vouchers in return for their old furniture and has taken advantage of Black Friday to promote this upcycling initiative. Sustainable initiatives such as these can:

- Build stronger customer relationships

- Raise consumer awareness of waste disposal

- Provide an alternative source of raw materials

- Reduce environmental impacts

Consumers have no preference for where to buy second-hand items

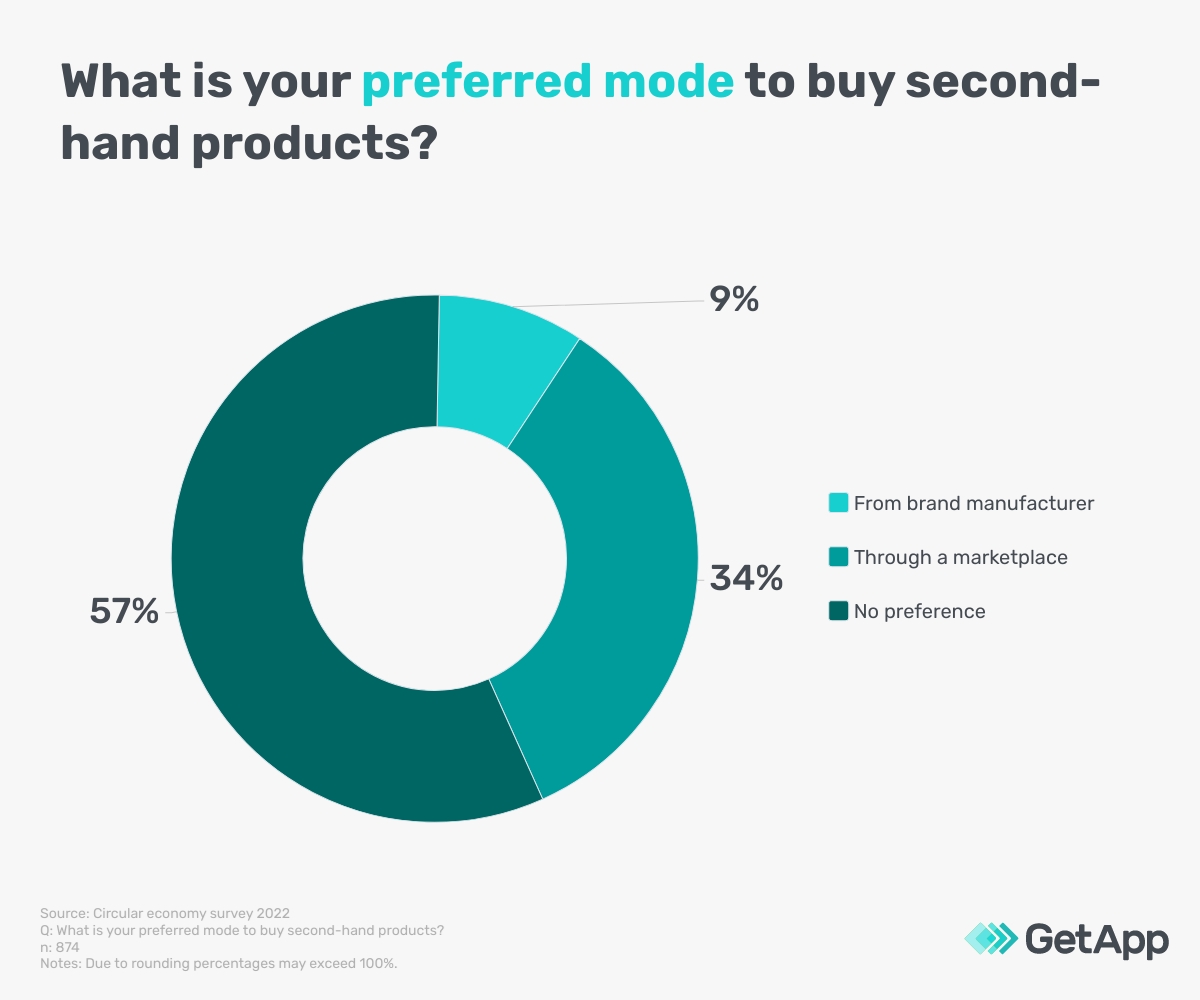

Low consumer engagement in buy-back programs may be because consumers feel it isn’t worthwhile selling certain products back to the manufacturer. This may also be because some consumers find it more convenient to use other channels, such as online resale marketplaces —where they can get cash rather than store credits— or because they don’t have to transport their used goods to a retailer.

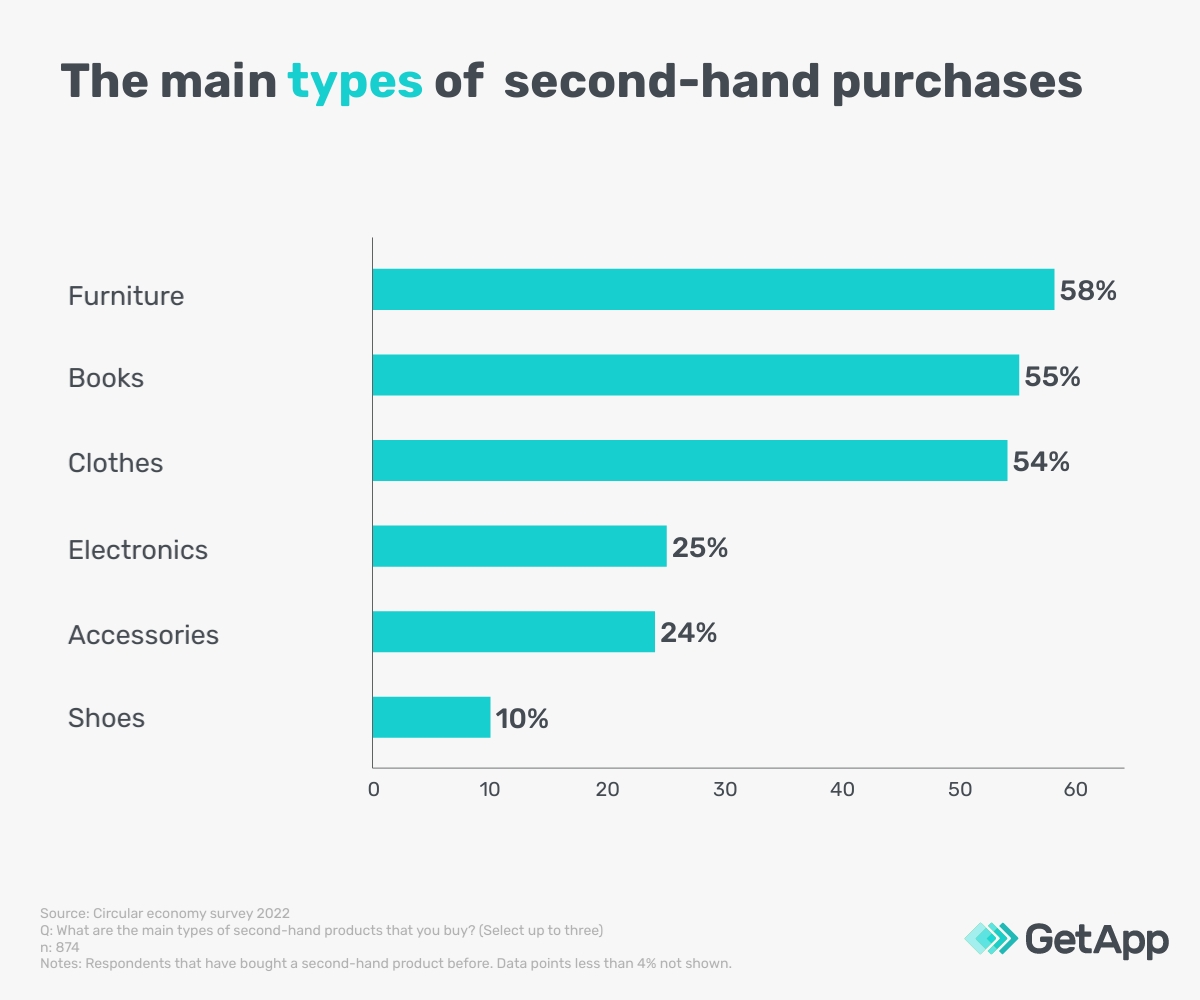

Our survey respondents said furniture, books, and clothing are the main types of second-hand products they buy. Demand for these products might also influence consumers who may choose to sell them instead of participating in buy-back programs.

Furthermore, we asked respondents that currently buy second-hand products which was their preferred mode to purchase them. The majority (57%) of these respondents said they didn’t have a preference, and would be happy to buy them either from the brand that manufactured the product or through a marketplace. This result may suggest that consumers are open to purchasing second-hand items in whichever channel they can find the best deal.

Consumers buy second-hand to save money, not the planet

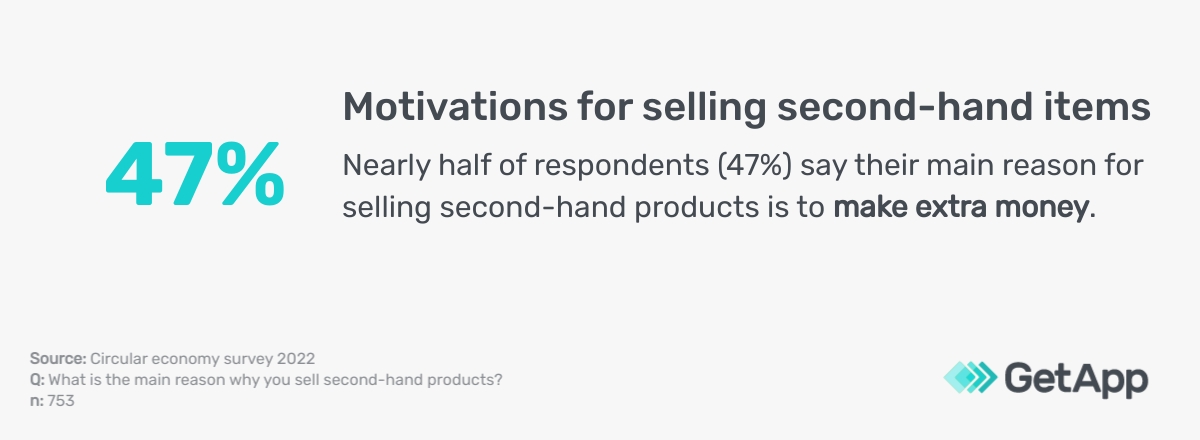

Usually, price rules everything when shopping for second-hand items. Often, valuable items are found for a bargain or at negotiated prices. Of the respondents that currently buy second-hand products, 47% said the reason for buying second-hand was a way to save money. A further 12% of survey-takers also indicated financial reasons, saying they can’t afford the original price of some products.

Only 11% of respondents said that they choose to buy second-hand products to promote sustainability, and a further 8% because they are interested in trying to extend the life cycle of existing products.

Therefore, consumer reasoning for second-hand purchases may confirm that the current economic downturn is leading consumers to look for cost-saving alternatives. Low consumer engagement in manufacturer buy-back programs may also suggest that consumers are looking to resell to make an extra income due to rising living costs.

Online marketplaces attract second-hand sellers

Bargain hunters nowadays have a variety of online and offline channels where they can find second-hand deals. When we asked those who currently buy second-hand products to indicate all the places they shop for these, the majority (70%) said they still use physical second-hand shops and 61% use online marketplaces that offer a variety of second-hand products. On the other hand, the majority (76%) of those who currently sell second-hand items make use of these online marketplaces.

Second-hand shoppers may be more inclined to shop at physical stores such as the Australian Red Cross, where donated items may be cheaper than online and can also be checked for quality. Additionally, non-profits raise money for good causes, thus incentivising buyers to shop there. From our survey field, we found a combined majority (87%) of respondents ‘somewhat agree’ or ‘strongly agree’ that they gift or donate products they no longer use. However, the Australian Red Cross among other non-profit organisations has a policy regarding pre-loved goods that it doesn’t accept, which may also encourage sellers to use online marketplaces.

In contrast, the option of buying and selling second-hand products through specialised online channels was low among respondents. Only 14% of respondents that buy second-hand products said they use specialised apps or websites to buy them and similarly, only 11% of respondents that currently sell second-hand products use these channels.

Opportunities for specialised online stores

Our survey results indicate that saving or making money are the main motivations for Aussie consumers when buying or selling second-hand products. Hardship in the current economic climate may be more of a motivating factor for consumers than environmental concerns. As a result, more and more consumers are using online resale marketplaces.

Online marketplaces have the most users that currently buy second-hand items in comparison to other online channels. However, companies that are interested in getting a share of the market may be better off seeking niche resale opportunities for specific second-hand goods instead of competing against established platforms that dominate the market. Additionally, respondents from the survey don’t have a preference as such to buy from marketplaces. However, businesses looking to enter the market with an online resale store will need to carefully evaluate what bargains their customers are after and identify their target market.

Methodology:

To collect this data, we conducted an online survey in July 2022 in Australia (1,013 participants). The candidates had to fulfil the following criteria:

- Resident in Australia

- Above the age of 18

- Must have identified the generation they belong to

- Understand the concept of a circular economy (after being shown a definition, respondents were able to select the correct description of a circular economy from a choice of three)