Digital wallets might have become a popular payment method these days, specifically since the pandemic. But are Australian customers comfortable with going fully cardless for daily payments? Read more to find out about customer behaviour regarding such wallets and how frequently they are being used.

In this article

- Digital wallets: meaning and functions

- Majority of Australian customers use digital wallets

- 79% use digital wallets as debit/credit cards

- Majority of respondents find digital wallets more convenient

- Most popular digital wallet options for Australian users

- The COVID-19 pandemic pushed users towards digital payments

Digital wallets generally allow users to store their financial information, identification documents, and other essential details on their mobile devices, potentially replacing the need to carry wallets altogether. But are Australian customers completely ready to go digital and ditch their wallets?

To find out more about their use and adoption in Australia, we surveyed 1,005 participants who are smartphone users and understand what digital wallets are. We surveyed these participants to understand how they use them, how frequently they use them, and which is their most preferred wallet platform, among other questions. The full methodology can be found at the bottom of this article.

Digital wallets: meaning and functions

Digital wallets or electronic wallets are financial platforms that help users make online payments using their mobiles or other similar devices. They generally store users’ payment information and credentials —including credit card and debit card details— and facilitate payments without the need to carry physical wallets. Google Pay and Apply Pay are some common examples of such platforms.

In addition, some such wallets can also store gift cards, loyalty cards, identification cards, event tickets, coupons, membership cards, and plane tickets. Digital wallets can be in an app format or serve as wallets in platforms such as PayPal and WeChat Pay. They work as an electronic version of your physical wallet and authenticate your payments through encryption to securely send money —for instance— from a customer to a merchant.

Is the buy now pay later (BNPL) payment method also part of digital wallets?

BNPL is a financial service that lets users purchase goods first, and then pay for them later in more convenient instalments. Such services are not exactly types of digital wallets but more like an ‘ online payment service that enables customers to purchase goods using (mostly) interest-free credit and pay for the items at a later date’, according to a report by GetApp.

Majority of Australian customers use digital wallets

To understand the comfort level of users and the adoption of digital wallets, we asked respondents whether they have ever used them. The majority (53%) of the respondents said they are currently using digital wallets —this term includes debit/credit digital cards, digital tickets, or digital identification cards. The other responses to the question are as follows:

The data clearly indicates that the majority of the respondents are currently using such online wallets and only 6% of the total state that they used them previously but won’t be using them in the future. We also asked these 6% of respondents why they stopped using them. Of these respondents, the majority said that they prefer using physical cards (57%), followed by other reasons such as data protection concerns (30%), disliking dependency on their phones (25%), and unwillingness to store sensitive information on their smartphones (23%).

Surprisingly, 68% of the total respondents were already aware of the concept of digital or online wallets before reading the definition in the survey questionnaire. Moreover, only 2% of them were neither familiar with the concept or the name. This data points towards the fact that the concept of digital wallets is not new, and a significant proportion of respondents knew precisely what the term meant even before they answered the survey questions.

What are the different types of digital wallets?

According to the Parliament of Australia, ‘ digital wallets can be either ‘open’ or ‘closed’. Open wallets enable transactions between any customer and merchant with the appropriate technology to submit, receive, and process a transaction. Closed wallets allow customers to transact only with a single merchant or a specific group of merchants and generally do not enable users to withdraw cash.’

Are users hesitant or unwilling to use digital wallets?

On whether they have ever used online wallets, 20% of the respondents said they have never used them before but are interested. To the same question, 22% said they have never used them and are also not interested in using them in the future. We asked them to state the reasons behind this hesitancy, and these are the responses we got:

- 60% of survey takers are worried about data protection

- 59% of them don’t want to store sensitive information on their smartphones in case it gets stolen

- 50% said they find digital wallets unnecessary

- 34% of them don’t want to be even more dependent on technology than they already are, and 11% find digital wallets complex to configure

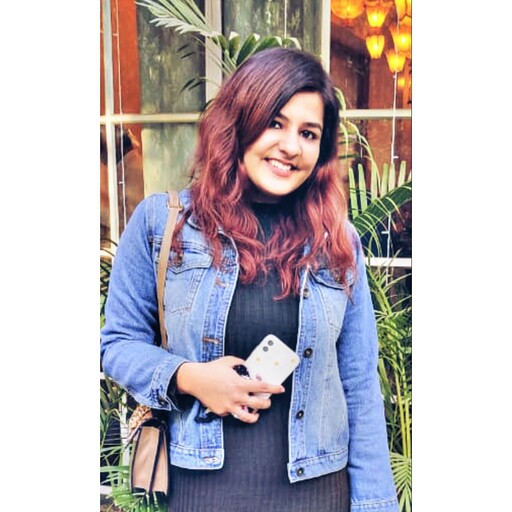

79% use digital wallets as debit/credit cards

The 53% of respondents who are currently using digital wallets were asked to state the purpose for which they use such digital wallets the most. These are their responses:

Clearly, most (79%) respondents use their digital wallets as debit/credit cards for payment purposes. The potential reasons why the majority of the surveyed respondents opted for this option could be:

- It usually only takes one step to add your card information to the digital wallet platform, and users can keep paying for their purchases without needing to enter their card details repeatedly.

- A digital wallet generally completes the transaction via secured encryption; hence, the chances of data being passed directly to the merchant can be potentially minimised.

- Such wallets can also potentially eliminate the need to carry physical cards or cash.

Majority of respondents find digital wallets more convenient

Out of the current digital wallet user respondents, 78% of them find online wallets more convenient than corresponding traditional methods. Other advantages of using digital wallets —as stated by the respondents— are as follows:

- 43% prefer them as they don’t have to carry their wallet and therefore risk losing it

- 31% find it easier to track their use

- 26% say that digital wallets make it easier to demonstrate their identity

- 18% of them feel that digital wallets may help reduce fraud, as the information they store is typically encrypted

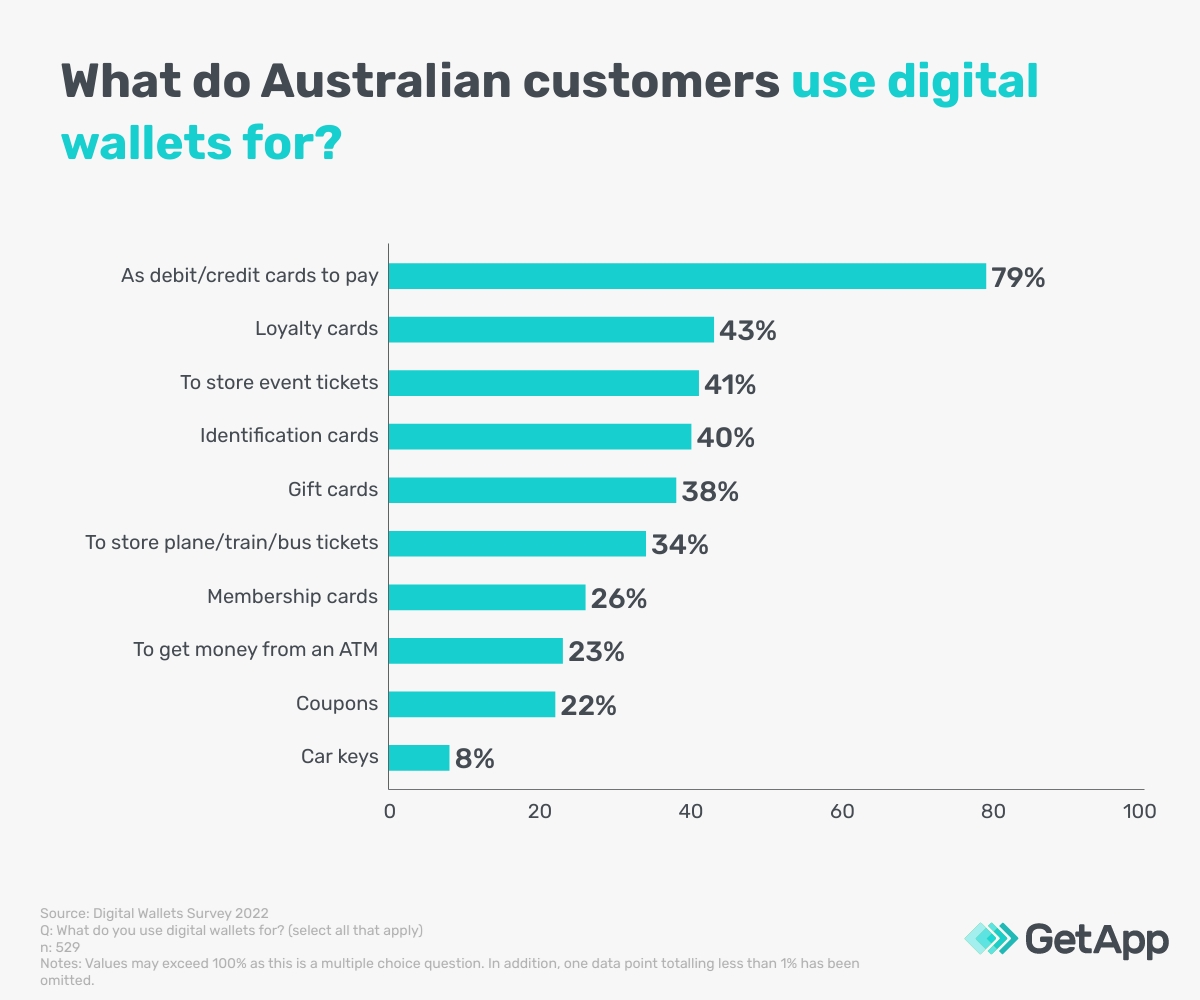

Some disadvantages of using digital wallets

We asked the proportion of respondents currently using digital wallets (53%) to select up to three disadvantages of using them, and these are their responses:

Clearly, half of the respondents (50%) are concerned about digital wallets leading to increased dependency on smartphones.

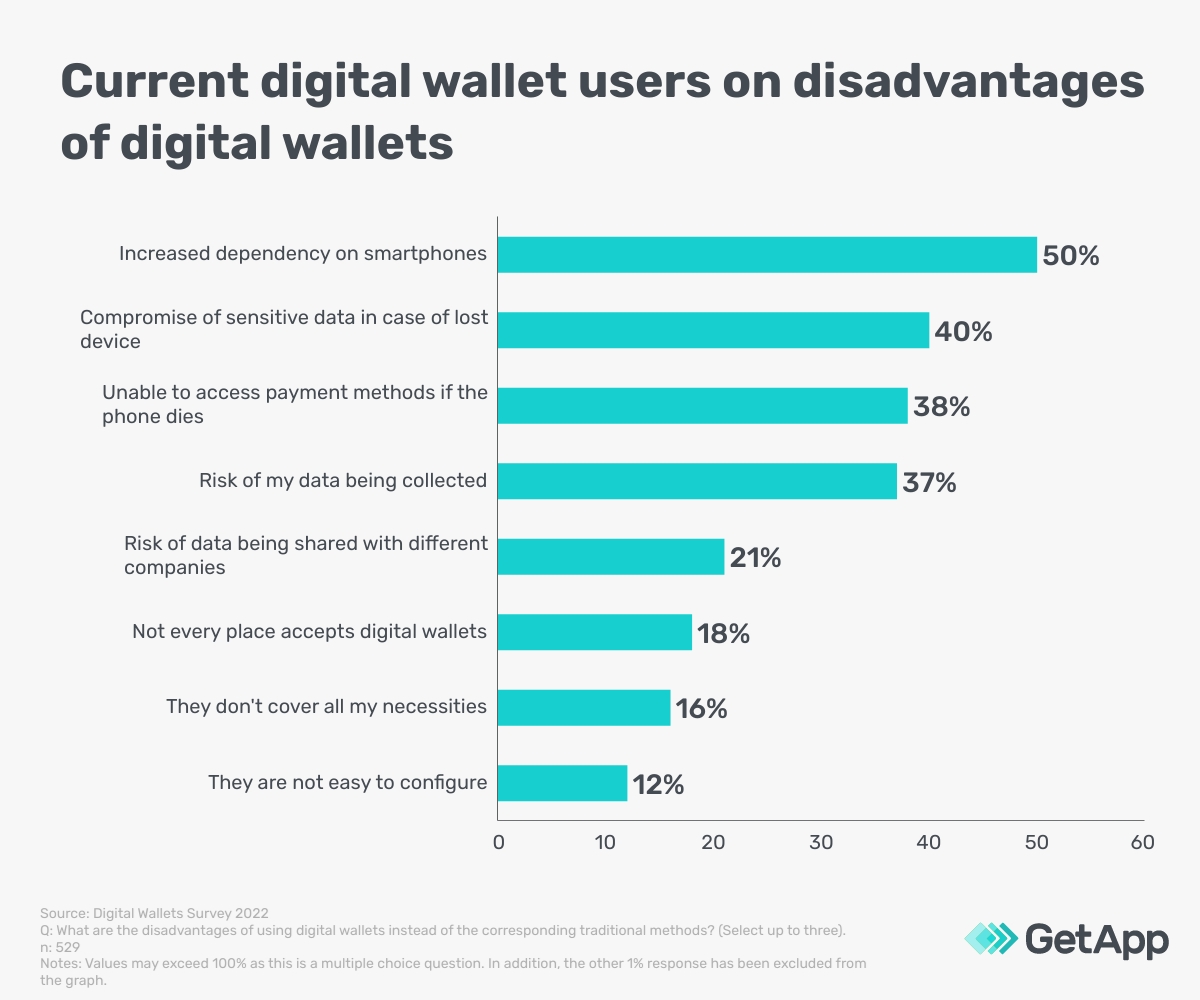

Most popular digital wallet options for Australian users

The respondents who use digital wallets as debit/credit cards were asked to identify which vendor’s digital wallet is their primary means of payment. 58% of respondents selected Apple Pay as their preferred digital payment platform. The other responses are as follows:

According to a survey report by Statista, ‘ 48 percent of respondents answered the question—which of these services have you used in the past 12 months to pay in stores, restaurants or other points of sale with your mobile device (e.g. smartphone)? with Apple Pay’. This report and the data from our survey clearly show that Apple Pay is one of the most popular digital payment options for Australian customers.

The COVID-19 pandemic pushed users towards digital payments

The same set of respondents who use digital wallets as debit/credit cards to pay were asked about their agreement or disagreement on whether the pandemic pushed them away from using cash and towards more digital means of payment. Unsurprisingly, a combined total of 78% of respondents —with 40% somewhat and 38% strongly— say that the pandemic pushed them more towards digital payments.

The situation of nationwide lockdowns and people sticking to online platforms for daily purchases might have been a major contributing factor. As per the World Bank, ‘the pandemic has also led to an increased use of digital payments. In low and middle-income economies (excluding China), over 40% of adults who made merchant in-store or online payments using a card, phone, or the internet did so for the first time since the start of the pandemic’. This data points out the fact that hygiene concerns regarding physical cash payments during the pandemic might have also led to a rise in digital payments.

Australian Cybersecurity Magazine states that ‘ Australia was already a leading market for cashless payments and digital wallets before the pandemic struck’. In addition, our survey data also indicates that respondents are currently using digital wallets. This shift in customer behaviour might create new equivalent opportunities for merchants. Online businesses can perhaps use this opportunity to ensure a smoother shopping experience for customers, build brand loyalty, and boost sales.

In the second part of our two-part series, we will discuss which factors and conditions are essential for Australian consumers to move to digital wallet payment options.

Methodology

To collect data for this report, GetApp conducted an online survey from 27 September to 7 October 2022, gathering the participation of 1,005 respondents. The selection criteria for participants were as follows:

- Australian resident

- Over 18 and below 76 years old

- Have a smartphone

- People who read and understood the definition of digital wallets in the survey questionnaire: ‘Digital wallets are smartphone/smartwatch apps that can store payment details and different types of ID/credentials (credit card details, gift cards, tickets, driver’s license, etc.) and allow users to pay without using a physical credit/debit card or to identify themselves and/or enter a place without a physical ID, credential or ticket’.